Bank reserves are the money minimal that banks ought to have at hand to meet the central finance company’s demands. This is physical cash that must be stored by the finance company in a vault close by or kept in an account in the central finance company. Money reserves demands are meant to ensure that every finance company can handle any huge and unplanned demands for debits. In the United States, the federal reserves mention the sum of money, which is known as the reserve ratio, which every finance company must meet up to.

Bank reserves are mainly a vaccine to panic. The federal reserve demand finance companies to handle a particular sum of money in the reserve so that they can never run short of money, thereby refusing a client’s withdrawal, which can possibly cause a bank run.

A central finance company may also make use of the finance company’s reserves as equipment in a finance scheme. It can reduce the reserves demands so that financial companies can make a quantity of fresh dense reserves to slow down the financial growth.

In recent years, the United States Federal Reserves and the central finance companies of some other developed financial institutions have turned to other strategies like quantitative easing (QE) so as to gain the same aims. The central finance companies in developing countries like China keep on depending on increasing or decreasing financial institutions’ reserve levels to lower down or high up their financial status.

The Demanded and Excess Bank Reserves

Financial institutions’ reserves are named demanded reserves or excess reserves. The demanded reserves are the minimal money the finance company can keep on hand. The excess reserves are any money above the demanded minimum that the finance company is saving in its vault instead of borrowing it from establishments and clients.

Financial institutions have small incentives to handle excess reserves as money earns no profit and can even depreciate over time as a result of inflation. Therefore, financial institutions usually reduce their excess reserves, thereby giving out the money to their customers as loans instead of storing it in their vaults.

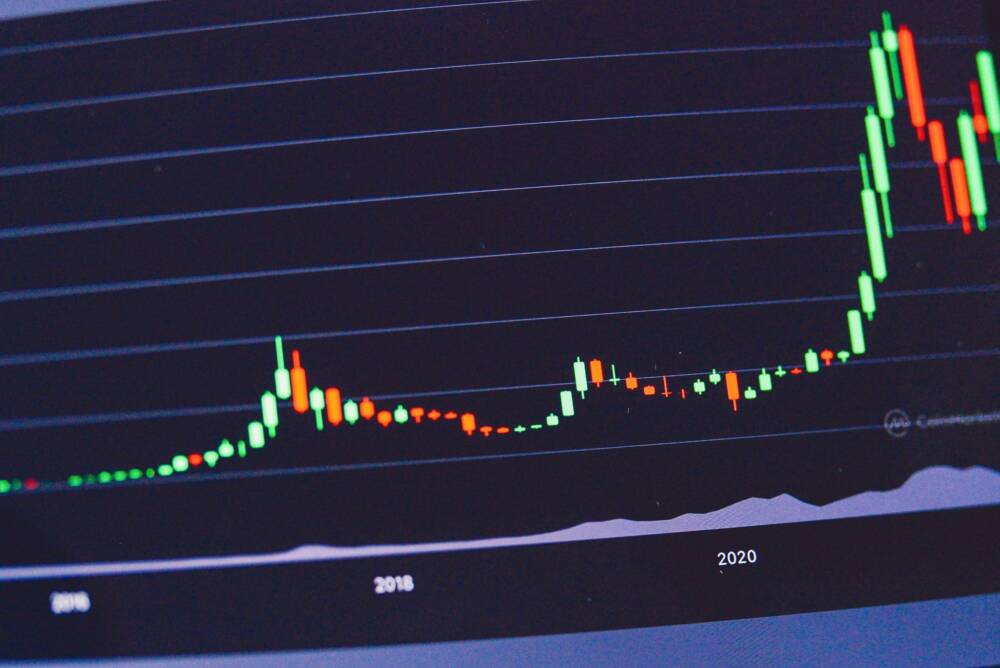

During the good times, establishments and clients tend to borrow more and also lavish more, and during the recession periods, they do not or will not take on extra debt. In downtimes, the financial institutions may also tighten their loan demands to avoid issues. Also, bank reserves reduce during the time of financial extension and go up during a recession.

How the Bank Reserves Came About

Notwithstanding the trials of Alexander Hamilton and the others, the United States did not own any national financial system for more than a few short periods until 1913, when the federal reserves system was formed. Until that period, states permitted and controlled financial institutions with different results. Financial institution collapses and runs on financial institutions were very regular until a wide-blown monetary panic in 1907, which led to the calls for Reformations. Then the Federal Reserve system was formed to govern the country’s funds supply.

Its office was notably extended in 1977, which was the period of double-digit inflation; Congress explained cost stability as a national scheme aim and formed the federal open market committee within the country to carry it out.

Things to Consider

The demanded finance company’s reserve joins a formula group by Federal Reserve board regulations. This formula lies on the total sum pay-in in the finance company’s net trading amount. The digit has to do with demand pay-in, automatic sending account, and the share draft record. Net payments are counted as the total sum in transaction records subtracting finances due from other financial institutions and the money still being received.

A central finance company can also handle the demanded reserves ratio as equipment to place in finance schemes. Through this ratio, a central finance company can affect the sum of cash that is ready for lending.

Liquidity Coverage Ratio

Adding to financial institutions’ reserves demands posed by the Federal Reserves, financial companies must also join the solvency demands that the Basel Accords implement. This Basel accord is a group of financial company regulations formed by agents from important world financial centers.

After the destruction of the United States Investment bank Lehman Brothers, which happened in 2008, the Basel Accords got their strength in an agreement which was known as the Basel III. This demanded financial institutions keep an appropriate liquidity coverage ratio (LCR). This LCR demanded that financial institutions and other banks handle enough money and solvent assets to secure outflows for a month.

During the period of the monetary crisis, the LCR is formed to assist financial institutions from getting to borrow cash from the central finance company. The LCR is meant to ensure that financial institutions have enough funds to drive out any short-term asset disruption. It is worthy to note that even as the federal reserves reduced the finance company’s reserves to a minimum, the finance company must still meet the LCR demands to ensure that they acquire more than enough money on hand to meet their short-term rights.